Restaurant Financial Management

Table of Contents

Managing a restaurant’s finances is not merely about balancing the books; it’s about orchestrating a symphony of costs and revenues to create a harmonious flow of profits. In the culinary world, where every ingredient counts, understanding the nuances of restaurant finance management is akin to mastering a complex recipe. From budgeting and cash flow to controlling labour costs and navigating the unpredictable terrain of profitability, the journey to culinary success is paved with financial acumen. In this article, we explore the intricacies of restaurant finance management, exploring strategies to keep the financial ship afloat and steer it towards the shores of prosperity.

How to Manage a Restaurant Finance Effectively

To create a restaurant finance management strategy and start generating profits, you have to define each cost to determine which items are a must-have and which are nice-to-haves. Then, you can include these costs in your budget. This will make it easier to identify the costs that are out of your control.

Budgeting

In addition to keeping track of yearly expenses, restaurant owners must plan for variable costs. You need to predict annual expenses to avoid overspending. If you underestimate sales, you may end up disappointing investors and creating a panicky work environment. To avoid this:

- Set a realistic sales goal and plan for it.

- Communicate this budget to manage and hire the right people.

- Ensure your budget reflects realistic trends, but it’s not a secret.

One of the fundamental aspects to consider in budgeting is your prime cost. This represents the highest expense in a restaurant and signifies the areas of profit that you control. In simpler terms, if your sales exceed your costs, you are in the black. However, if your expenses outweigh your sales, your profits will be significantly lower. Therefore, it’s crucial to keep these costs under control. Moreover, planning for growth and considering strategies to boost your sales volume is essential if you’re not generating enough revenue to cover costs. Understanding and managing your prime cost is key to maintaining the financial health of your restaurant.

When preparing your Pro-forma P & L, a key aspect is understanding the cost of each line item. It’s best to forecast the key line items in three ways: conservative, expected, and aggressive. The conservative forecast, for instance, assumes that the restaurant didn’t attract enough customers. On the other hand, the aggressive forecast assumes the opposite, offering the highest return on investment. This sales forecasting is crucial as it helps in setting realistic goals and managing resources effectively. When calculating your sales, it’s important to factor in the number of employees you plan to hire, ensuring your budget aligns with your operational needs.

A restaurant’s budget will also help it evaluate its operations and investments. By establishing a budget, restaurant owners will have a clearer picture of what they need to change for long-term growth. COVID-19 caused the restaurant industry to pivot quickly, changing staffing, food, and marketing budgets. Restaurant owners must also plan for unexpected expenses, like the COVID-19 virus or a new business model that uses digital marketing.

Cash flow

Managing cash flow in a restaurant is essential for success. The key to restaurant finance management is a successful cash flow management strategy that includes forecasting sales and sticking to a budget, which helps restaurant operators set goals and plan for minor adjustments. It is also essential to know how much money you can spend on certain types of expenses. For example, a restaurant’s cash flow should remain at a steady level if you are preparing for a snowstorm on Tuesday. A declining budget may result from increased food costs on Wednesday and vice versa.

To manage cash flow in your restaurant successfully, you should assess your expenses and potential investments. Consider whether it’s worth it before investing in new technology or hiring a new employee. Such investments may take a while to pay off. You should carefully consider any expenditures or investments not immediately necessary to run your business. By taking your time and thinking through the investment, you can prevent cash flow problems that will allow you to invest in the right things to improve your business.

In addition to tracking your income and expenses, you should also monitor your inventory. Don’t keep unused inventory sitting in the stockroom or under the sink. Try offering “Get it while it’s on sale” promotions to get your customers to spend more money. In addition, you should pay your vendors promptly, as late payments can incur additional charges. To avoid these pitfalls, avoid using credit cards to pay invoices – if these are not reconciled by your accounting team, they may result in bills being paid twice.

In addition to keeping an eye on overhead costs, restaurant owners should also pay close attention to menu items that don’t sell and over-ordering food. Payroll errors can also negatively impact cash flow. Many restaurants automate payroll processes to improve efficiency and profitability. Restaurants have seasonal slumps and peak times, but their cash flow remains relatively stable. By carefully analysing their cash flow, restaurant owners can identify and invest in draining processes.

Controllable versus Uncontrollable Costs

While some expenses are beyond your control, there are still many ways to reduce these expenses. Using analysis, strategic thinking, and a proactive approach, you can cut the costs of the uncontrollable parts of your business. To reduce restaurant expenses, you must maximise the cost savings from the things you can control. Make sure you understand the differences between controllable and uncontrollable costs.

Understanding the distinctions between fixed and uncontrollable costs is crucial when managing your restaurant’s finances. Non-fixed costs are variable and not guaranteed, whereas fixed costs are, by definition, constant and must be paid monthly whether or not you generate sales.

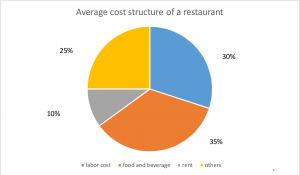

To achieve your restaurant finance management goals, you must start by looking at your financial statements; controllable costs are expenses you can control directly, including direct labour, material costs, advertising, and labour. Other costs you can’t control include organisation-wide advertising, mortgage, real estate taxes, and insurance. You can reduce controllable costs by focusing on the ones you can manage. For example, you can cut employees’ travel costs. Keeping costs low is essential for any restaurant’s financial health.

Reducing uncontrollable costs can be achieved by hiring a qualified manager. If you lack management expertise, employing an experienced restaurant manager is recommended. While hiring a family member or friend to manage your business may seem convenient, it’s essential to bear in mind that the costs of running a restaurant can quickly add up. Therefore, hiring a qualified manager and recognising and rewarding your top performers is advisable.

It is essential to monitor all expenses related to operating your restaurant since they can significantly affect your earnings. While some expenses, such as indirect costs, may be out of your control, others, like labour costs, can influence and make it more profitable. Labour costs can be higher than expected, but you can effectively manage expenses and increase profits by controlling them. Ultimately, your restaurant’s success depends on how well you can manage and control expenses to maximise profits.

Managing Labour Costs

Restaurant operators need to monitor their costs to avoid the unnecessary expenses of paying overtime and understanding their kitchens. To ensure their restaurant does not face this problem, they must schedule the least number of employees possible. Low staffing can lead to long lines, increased wait times, and customer attrition. A balance between employee schedules and revenue data can help restaurant operators ensure their labour costs are within 30% of the total gross revenue.

Managing labour costs in a restaurant should start with setting a goal. Usually, restaurant owners look at labour costs as a percentage of sales. However, if you have an average of 40% during January, you should look deeper into the reasons behind the spike. The average labour cost does not tell you about overstaffing, slow days, and special events that increase labour costs. As a result, setting a goal for a certain percentage will help you make adjustments and keep your restaurant profitable.

The key to managing labour costs in a restaurant is to identify high-value employees. This way, you can leverage the strengths of your entire team. You can cut others earlier if you can hire the most efficient staff members. For example, you could schedule servers with the highest sales average so that they can increase revenue and decrease labour costs. By doing this, you will maximise the profits of your employees and the bottom line of your restaurant.

It is important to monitor labour metrics closely. Restaurant managers should make sure they understand their actual labour costs and schedule employees according to these. This will prevent costly overruns.

Smart employee scheduling based on sales Per Labour Hours (SPLH) goals can help restaurant managers optimize each part of the labour cost. This can lead to massive savings in your restaurant’s budget. If you do not have a good understanding of your labour costs, you can use a labour-cost calculator to find out how much you can cut from your expenses.

Related articles:

How To Improve Restaurant Profits

Restaurant Management Structure

Managing Payroll

Managing payroll for restaurant finance management can be challenging. The process involves more than just calculating employees’ hourly wage; it also requires withholding taxes, paying into benefits and complying with restaurant labour laws. Restaurant owners must keep records of each employee’s pay, including receipts, bank statements, and tax forms. Additionally, collecting payroll documents is essential for compliance and tax withholding. Most restaurants pay employees weekly or bi-weekly.

Managing payroll is crucial to running a restaurant, and its significance should be noticed as it includes managing employee income taxes and wage garnishments for child support, among other things. Efficient payroll management can make the difference between a successful and struggling restaurant. Fortunately, various payroll systems are available that can streamline the process, minimizing the risk of fines or fees due to errors. Restaurant managers can save valuable time by simplifying payroll calculations with these systems and focusing on other aspects of their business.

Outsourcing payroll administration is a cost-effective solution for many restaurant owners. It’s common practice to delegate payroll tasks to an accountant or a payroll service. If you’re new to restaurant finance, hiring an accountant can be a wise move. A payroll service ensures accurate payroll tax calculations, compliance with labour laws, and receipt of the correct tax credits. This frees up your time to focus on other crucial areas of your restaurant, such as marketing.

Using payroll software can help you track expenses in real-time. Restaurant payroll software lets restaurant owners see the ratio between their daily profits and losses. Managing payroll for restaurant finance requires adequate time and resources, and you must use the gross pay of employees as a basis for calculations. In addition, federal, state, and local regulations govern overtime and tipping. These factors need to be calculated and monitored carefully.

Conclusion

In the dynamic landscape of the restaurant industry, where success is as much about flavour as it is about fiscal finesse, effective restaurant finance management emerges as the cornerstone of sustainable growth. By implementing prudent cost-cutting measures, leveraging technology to streamline operations, and adopting a strategic approach to financial decision-making, restaurant owners can confidently navigate the choppy waters of economic uncertainty. Through meticulous attention to detail and a commitment to financial discipline, the tantalising aroma of success beckons, promising a feast of profits for those who dare to master the art of restaurant finance management.

(FAQ) Frequently Asked Questions And Answers

How long does it take for a new restaurant to make a profit?

The time it takes for a new restaurant to turn a profit can vary greatly depending on factors like restaurant type, location, competition, management, and business strategy.

Some restaurants may start making money within a few months, while others may take several years. According to a National Restaurant Association study, a new restaurant typically takes 2-3 years to become profitable.

However, depending on the abovementioned factors, it could be longer or shorter. Many new restaurants fail within the first year due to insufficient planning, undercapitalisation, and poor management.

A realistic business plan and sound financial management can be critical to success; they must determine the break-even point and keep the business on track to profitability.

Furthermore, careful financial management and regular changes to pricing, menu items, and marketing strategies can help accelerate the path to profitability.