First Published on: 9 May 2022Financial Management In Food Service

Essential for the success of a restaurant is the skilful handling of daily finances, a task that rests upon the restaurant manager’s or owner’s shoulders. Guaranteeing the continued efficiency of the business necessitates a thorough comprehension of both the timing and nature of financial transactions. Establishing a budget, incorporating allowances for ingredients and labour costs, and consistently adhering to it, is crucial. Proactively formulating your budget enables you to steer clear of unforeseen expenses, maintaining the profitability of your restaurant. Below are some tips to help you manage your daily finances.

Restaurant CashFlow

Monitoring cash flow is essential in the realm of restaurant financial management. Cash flow pertains to the flow of money in and out of a restaurant. Operating a restaurant requires a comprehensive grasp of your cash flow.

To calculate your cash flow, divide your cash inflow by your cash outflow. You can easily estimate your cash flow by subtracting your cash outflow from your cash inflow. Include any upcoming expenses, such as food orders. You should always be prepared for unexpected charges when running a business.

First, you must determine how much money you will require to run your business. Calculate your restaurant’s cash flow or money flow in and out regularly.

You should also be aware of your restaurant’s outlandish expenses. The ability of a restaurant to manage its cash flow is critical to its overall success. You must understand how much money your company makes. Before cash flow can be calculated, cash-out must be subtracted from cash-in. The difference is in the balance of your bank account.

You may calculate how much money you must spend by dividing your current cash flow by your total number of consumers. Knowing your cash flow is essential before choosing between raising pricing and knowing how much money you need to pay monthly bills.

Managing the cash flow of your restaurant is critical to its long-term viability. The fixed and variable costs of your restaurant should be well understood. The success of your restaurant is dependent on determining your fixed and variable costs.

To begin, you should understand your current cash flow. A cash flow statement makes it simple to keep track of your expenses. This report displays the money flows into and out of your bank account. If your income exceeds your expenses, you are in the black. Money is a problem if you don’t have any. It is preferable to have a positive balance than a negative cash flow.

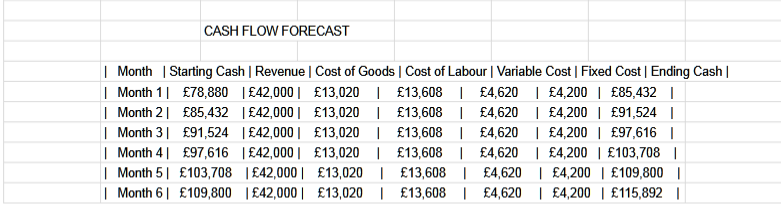

Budget Spreadsheet

A budget spreadsheet is one way to keep your restaurant finances on track. You can use this software to create detailed budgets to help you allocate your budget based on your actual expenses. You can always hire a professional if you need help with your accounting.

These tips will help you maintain your daily finances and keep your business running smoothly. However, you can hire a bookkeeper or accountant if you need more confidence.

Your first year’s goal should be to achieve break-even, which indicates that your revenue and expenses are equal. If you run your business well, in the second year, you will make more money than you spend.

A profit will be generated when your revenue surpasses your costs. Knowing and understanding your daily financials will allow you to maximise your profits and improve your revenues. By doing so, you can concentrate on improving the quality of your meals and services while maintaining a lucrative restaurant business.

As a restaurant owner or manager, you must regularly be aware of the financial aspects of your business. While a prosperous restaurant will always be lucrative, you’ll still need to manage your cash flow to keep ahead of the competition to be profitable.

Whether or not your company is profitable, managing cash flow is essential to achieving profitability. To run a successful restaurant, you need a solid management strategy.

Also important is keeping track of all expenses, which include salary and other labour. Setting up a budget and tracking expenses is essential for your restaurant’s growth and stability. By managing your money wisely, you’ll be able to capitalise on opportunities, weather terrible times, and maximise your profits.

It will also help you survive events like the recent COVID-19 pandemic, so financial management is extremely important. In addition to a reasonable budget, a solid budget will help you manage your daily expenses on time.

In addition to setting up a budget, you must track your daily sales and regularly check your monthly finances. You must know how much you spend on labour and other daily expenses. For example, your labour costs are your biggest expenses, typically between 25% and 30% of the total. You must manage your staff correctly to avoid losing customers and failing to appreciate your restaurant.

Establish A Budget.

The most important thing to remember is to track your costs. Monitoring your cash flow, which is the money you make and spend, is important. You should keep a record of everything you spend. By automating this process, you can set up your budget for the next few days and monitor your cash flow. If you need to make comparisons, keep an eye on the numbers.

Related articles:

How To Improve Restaurant Profits

Most Profitable Restaurant Types

How To Improve Restaurant Profits

Restaurant Inventory Management System

Restaurant Finance Management

Calculations You Need to Know

There are many calculations related to restaurant finance. Knowing these calculations can help you make sound business decisions. Fixed costs, for instance, are more predictable because they are a single bill or price. Variable costs, on the other hand, are guaranteed to change from month to month. The key to calculating these numbers is to use the previous year’s financial statements as a benchmark. This way, you can see if you’ve made any significant changes to your expenses.

The operating budget shows your costs. Expenses are broken down into two categories – controllable and non-controllable. The controllable cost is the most important because it reflects only the line items under your control. On the other hand, the non-controllable costs are ones that you cannot control. You can use these to create a more profitable financial plan.

The cost of goods sold analysis shows the total cost of your food and beverage inventory. This analysis helps you see your profit margin, the ratio of your revenue to your expenses. You should also include the costs of each service, including food and beverages. Your COGS is your net worth. The lower your income, the higher your profits will be. But if you’re in the red, knowing other ways to improve your profitability is essential.

COS

Gross Sales – £600,000

Cost of Promotions – £78,000

Employee Meals – £18,000

Net Sales = £504,000

Cost of Sales – £156,000

Gross Profits = £348,000

The cost of fixed expenses is the least variable. Keeping track of variable costs is crucial to the success of your restaurant. In addition, you need to know how much each type of cost is variable. In other words, you’re in trouble if you don’t have a cash-flow forecast. You don’t have enough cash, so you need to monitor your variable costs. If your income is high, you need to know your fixed costs.

The break-even point for a restaurant is the point at which expenses equal sales. In monetary terms, a restaurant’s expenses are equal to its sales. The average cost of a restaurant is the cost of labour, food, and supplies. These expenses are recurring. Hence, keeping a cash reserve for these expenses would be best. However, your business will be red if your income increases.

Profit and Loss Statement

Net Sales – £504,000 (100%)

COGS – £156,000 (31%)

Cost Labour – £163,320 (32.4%)

Total Semi-Variable Expenses – £55,400 (11%)

Total Fixed Cost – £50,400 (10%)

Net Profits – £78,880 ( 15.65%)

Comparable sales are a crucial metric for restaurant finance management. Similar sales measure a restaurant’s performance compared to other restaurants in the same area. Knowing your comparable sales can determine whether your restaurant is an outlier and should help you set a fixed price for your products and services. If you’re earning more than the average of your competitors, you’re on a soundtrack to success.

The cost of goods sold is the cost of food and beverages that your restaurant sells. It can be used to make management decisions and determine hypothetical menu changes. Usually, this figure starts at the beginning of a month or quarter and adds the inventory purchased over time. You’ll have a fixed cost per serving based on these measurements. The end of the month or quarter is the end of the year, and you’ll need to adjust your revenue accordingly.

Restaurant Finance Management 2023: How To Start Generating Profits

Restaurant Financial Analysis

If you’re considering starting your restaurant, understanding the financial aspects is crucial. Securing a loan or investment capital will be necessary to launch the business, and the amount needed will depend on the type of restaurant you plan to open. Consider bringing in a bookkeeper or accountant to assist in managing your finances effectively.

However, you need to know that a bookkeeper or accountant can teach the basics of financial management.

The interest rate on a restaurant loan varies. It can be high, low, fixed, or variable. When considering the loan amount, include property costs, such as taxes. A good financial plan will include fixed costs such as building repairs, food trucks, custodial services, consulting fees, and accounting fees.

In some cases, it may be helpful to hire a bookkeeper to handle this task for you. Managing restaurant finances doesn’t have to be tedious, but having a sound system is essential.

A good financial plan will help you budget your expenses and determine the best ways to cut unnecessary costs. It is important to monitor daily reports to keep track of your profits and costs. If you fail to keep track of these figures, it is possible to close the business.

If your restaurant finances are well managed, the restaurant operation will be easy, which is vital for any restaurant owner. It would be best to remember that savvy financial management will ensure your restaurant’s success.

You should also be aware of the costs of your employees and the menu. Your labour and food expenses are vital to the profitability of your restaurant. By reviewing these costs and revenues, you can make informed decisions about hiring employees and improving service quality.

Furthermore, it would help if you understood your customers and their preferences. Your clients will be happy if you have a well-run restaurant. In addition to this, your staff will feel satisfied as they will enjoy the food they are serving.

Your finances are the foundation of your restaurant’s success. You need to know how much you spend each day to maximise profits. Consider your restaurant’s fixed and variable costs to ensure that your business is profitable.

Depending on these factors, you should also pay attention to your restaurant’s cash flow to help you make sound decisions about hiring the right people for the job. A strong financial plan can ensure that your business will continue to grow.

Long-Term Financial Sustainability

Regularly review your long-term financial goals and make adjustments to your strategies accordingly. Consider investing in technology that can enhance efficiency, such as implementing point-of-sale systems and utilizing advanced inventory management tools. This ongoing process of evaluation and strategic adaptation, combined with incorporating relevant technological solutions, is essential for ensuring your business operations’ continued effectiveness and success.

Incorporate sustainability practices not only for environmental responsibility but also for potential cost savings. Energy-efficient equipment, waste reduction measures, and responsible sourcing can contribute to your bottom line and the positive image of your restaurant.

Frequently Asked Questions and Answers

How do restaurants manage finances?

Restaurants manage finances by employing various strategies, including meticulous budgeting, monitoring cash flow, and utilizing financial tools. Successful financial management involves:

- Understanding fixed and variable costs.

- Tracking daily sales.

- Creating a comprehensive budget to allocate resources effectively.

What are restaurant financials?

Restaurant financials consist of financial records and performance indicators that reveal the economic health of a restaurant. These documents comprise profit and loss statements, balance sheets, and cash flow statements. Understanding these financial metrics is crucial for restaurant owners and managers as it enables them to make informed decisions to maximise profitability. By analyzing and interpreting these key financial documents, restaurants can strategically plan and allocate resources, ultimately contributing to the establishment’s overall financial success and sustainability.

How do you do restaurant finance?

Managing restaurant finance involves calculating cash flow by reconciling cash inflow and outflow. Restaurant owners should be attentive to unexpected expenses, automate budgeting processes, and regularly reassess financial strategies. Employing skilled professionals, like bookkeepers or accountants, can further aid in effective financial management.

What is a financial plan for a restaurant?

A financial plan for a restaurant outlines the budget, expenses, and revenue projections to guide financial decision-making. It includes considerations for fixed and variable costs, strategies for cost-cutting, and plans for long-term sustainability. This plan is crucial for achieving break-even, maximising profits, and navigating challenges to ensure the restaurant’s financial success.

Conclusion

In conclusion, the financial management of a restaurant is a multifaceted endeavour that goes beyond day-to-day transactions. By understanding the intricacies of cash flow, employing practical budgeting tools, and making strategic decisions informed by financial analyses, you can position your restaurant for sustained success. Adaptability, customer-centric approaches, and a focus on long-term sustainability are integral components of a comprehensive financial strategy that will help your restaurant thrive in a competitive industry.

How to Improve Restaurant Profits and Increase Restaurant Sales