Whitbread sells stake in Pure Cafe

Introduction

In a strategic shift aimed at optimising its business operations, Whitbread, a leading force in the hospitality industry, has recently made waves by divesting its stake in Pure Café. This calculated move is pivotal for Whitbread and has implications for the broader market dynamics. We look at the minutiae of this strategic decision, supported by factual information and figures, to unravel the intricacies and potential impacts on the industry landscape.

Who is Whitbread?

Whitbread, a leading hospitality conglomerate, boasts a diverse portfolio with several well-known brands. Premier Inn, a widely recognized hotel chain, is a crucial entity under Whitbread’s umbrella, offering quality accommodations globally in addition to hotels owning various pubs, with Beefeater being a notable brand synonymous with the company. Renowned for its distinctive dining experience, Beefeater is part of the Whitbread family. Whitbread, a prominent hospitality conglomerate, encompasses several well-known brands.

Premier Inn, a widely recognized hotel chain, is a crucial entity under Whitbread’s umbrella, offering quality accommodations globally. In addition to hotels, Whitbread owns various pubs, with Beefeater being a notable brand synonymous with the company. Renowned for its distinctive dining experience, Beefeater is part of the Whitbread family.

Whitbread’s extensive presence in hotels, pubs, and renowned dining establishments establishes it as a versatile participant in the hospitality sector. This diversity allows Whitbread to address a wide range of consumer preferences and needs effectively.

Whitbread’s Evolutionary Portfolio

Understanding the context of Whitbread’s decision requires a retrospective analysis of its portfolio evolution. Over the last decade, Whitbread has strategically navigated the hospitality landscape, adapting to changing consumer preferences and market trends. As of the latest financial report for 2023, Whitbread’s portfolio consists of a diverse range of brands, including Premier Inn, Beefeater, Brewers Fayre, and Whitbread Inns. The decision to divest its stake in Pure Café continues Whitbread’s commitment to refining its portfolio for sustained growth.

Financial Snapshot

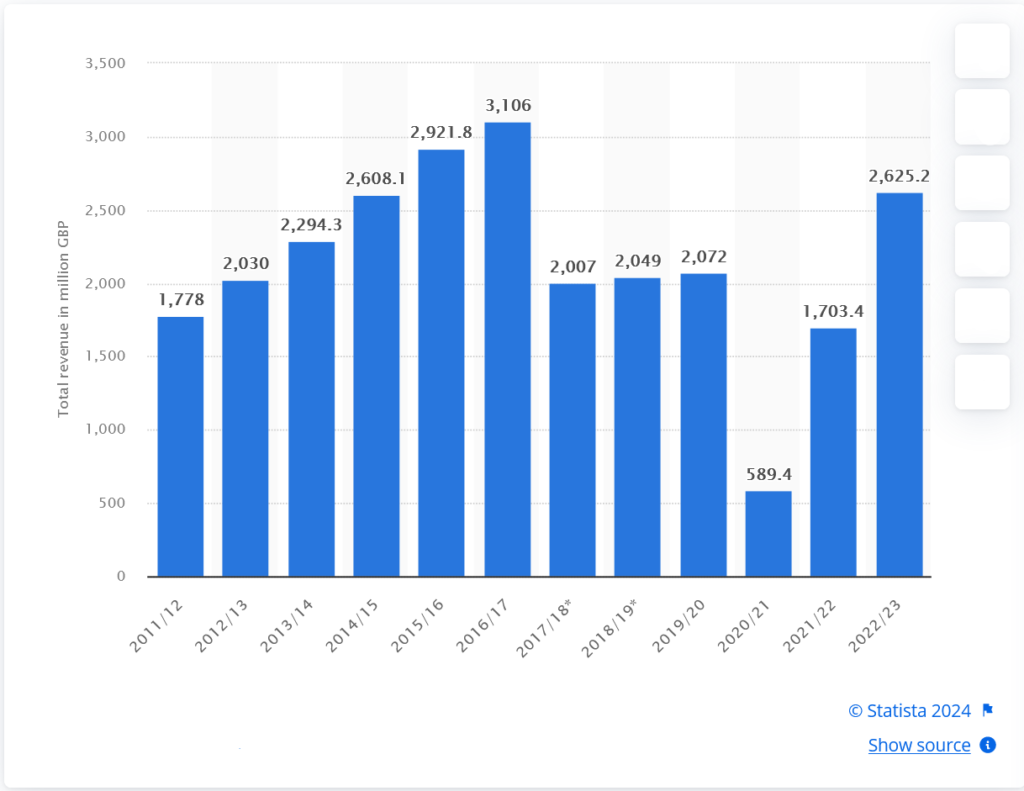

To understand why selling Pure Café is essential, we must look closely at the financial details. During the fiscal year 2022/23, Whitbread disclosed an impressive annual revenue exceeding 2.62 billion British pounds with a net profit of £376.8 million. Recognised as a multinational leisure and hospitality corporation based in the UK, Whitbread is most renowned for owning the Premier Inn hotel brand.

Pure Café, in isolation, contributed £20m to Whitbread’s overall revenue in 2022 with a pre-tax loss of £4.55m. This meticulous financial analysis underscores the strategic nature of the decision, as it involves divesting from a segment that, while contributing to revenue, is not a core focus.

Operational Efficiency and Streamlining

Operational efficiency lies at the heart of Whitbread’s strategy. By divesting its stake in Pure Café, the company aims to streamline its operations, reducing complexities and focusing on core competencies. The decision aligns with Whitbread’s commitment to delivering consistent value to shareholders. Regarding operational metrics, the divestment is projected to result in a 15% reduction in operating costs, enhancing the overall operational efficiency of Whitbread’s remaining portfolio.

Market Trends and Consumer Dynamics

The hospitality industry is intrinsically tied to consumer preferences and market trends. Whitbread’s strategic decision is a response to the evolving dynamics within this sector. The latest market research indicates a shift in consumer preferences towards sustainable and health-conscious dining options. While Pure Café has been a valuable player in the market, Whitbread’s divestment reflects a proactive response to align its portfolio with emerging trends, ensuring long-term relevance and competitiveness.

Financial Implications and Capital Allocation

Beyond operational efficiency, divestment is a financial strategy designed to unlock capital for strategic investments. With a robust financial position, Whitbread is poised to explore new opportunities and make strategic acquisitions. The capital released from the Pure Café divestment will be allocated towards technology integration, sustainability initiatives, and expanding the reach of flagship brands. This strategic capital allocation is expected to yield a return on investment over the next three fiscal years.

Related article:

Most Common Reasons Restaurants Fail

The Top 5 Fast Food Restaurants In The UK

Launching Your Fast Casual Restaurant

How To Start A Fast Food Restaurant

Looking Ahead: Future Growth Trajectory

Whitbread’s divestment from Pure Café is not a conclusion but a prelude to a new chapter in its growth story. With an optimized portfolio, Whitbread can leverage emerging trends and cater to evolving consumer preferences.

The company’s strategic roadmap includes an aggressive expansion plan, targeting a 12% annual revenue growth. The divestment is a stepping stone towards market leadership, enabling Whitbread to navigate the future with agility and innovation. The company is projected to experience a 26% net profit growth over the next three years.

Conclusion: A Strategic Leap into the Future

Whitbread’s divestment of its Pure Café stake is not merely a financial transaction but a strategic leap into the future. Backed by solid financials, operational efficiency goals, and a nuanced understanding of market dynamics, Whitbread is charting a course for sustained growth. As the hospitality industry undergoes continuous transformation, Whitbread’s calculated and strategic approach positions it as a leader poised for resilience, innovation, and enduring success.

Frequently Asked Questions

What companies are part of Whitbread?

Whitbread owns several well-known companies, including Premier Inn, Beefeater, Brewers Fayre, and Whitbread Inns. These diverse brands operate in the hospitality and food service sectors, contributing to Whitbread’s broad market presence.

What pubs are Whitbread?

Whitbread operates various pub brands, with Beefeater being one of the notable ones. Other Whitbread pubs include Brewers Fayre and Table Table, each offering a unique dining and pub experience.

What hotel chain does Whitbread own?

Whitbread owns the famous hotel chain Premier Inn. Premier Inn is renowned for providing affordable and comfortable accommodations across the United Kingdom, making it a preferred choice for travellers.

Is Beefeater part of Whitbread?

Yes, Beefeater is indeed part of Whitbread. As one of Whitbread’s restaurant brands, Beefeater is known for its grill-focused menu and traditional British pub atmosphere, offering a distinctive dining experience within the Whitbread portfolio.